🗞️ Financial Summary

European Markets: European stocks continue their upward trend, driven by accommodative monetary policies and increased government spending. The Stoxx Europe 600 index has risen 21% year-to-date in U.S. dollar terms.

Markets and Geopolitics: Risk aversion in the U.S. remains low despite tensions between Israel and Iran. The S&P 500 hovers near record highs, reflecting a lack of movement towards defensive sectors.

U.S. and Iran Politics: President Donald Trump is favoring a diplomatic resolution over immediate military action against Iran, easing fears of an imminent conflict.

Brent Crude Decline: Brent crude prices have fallen due to easing geopolitical tensions, while European stock markets have seen gains.

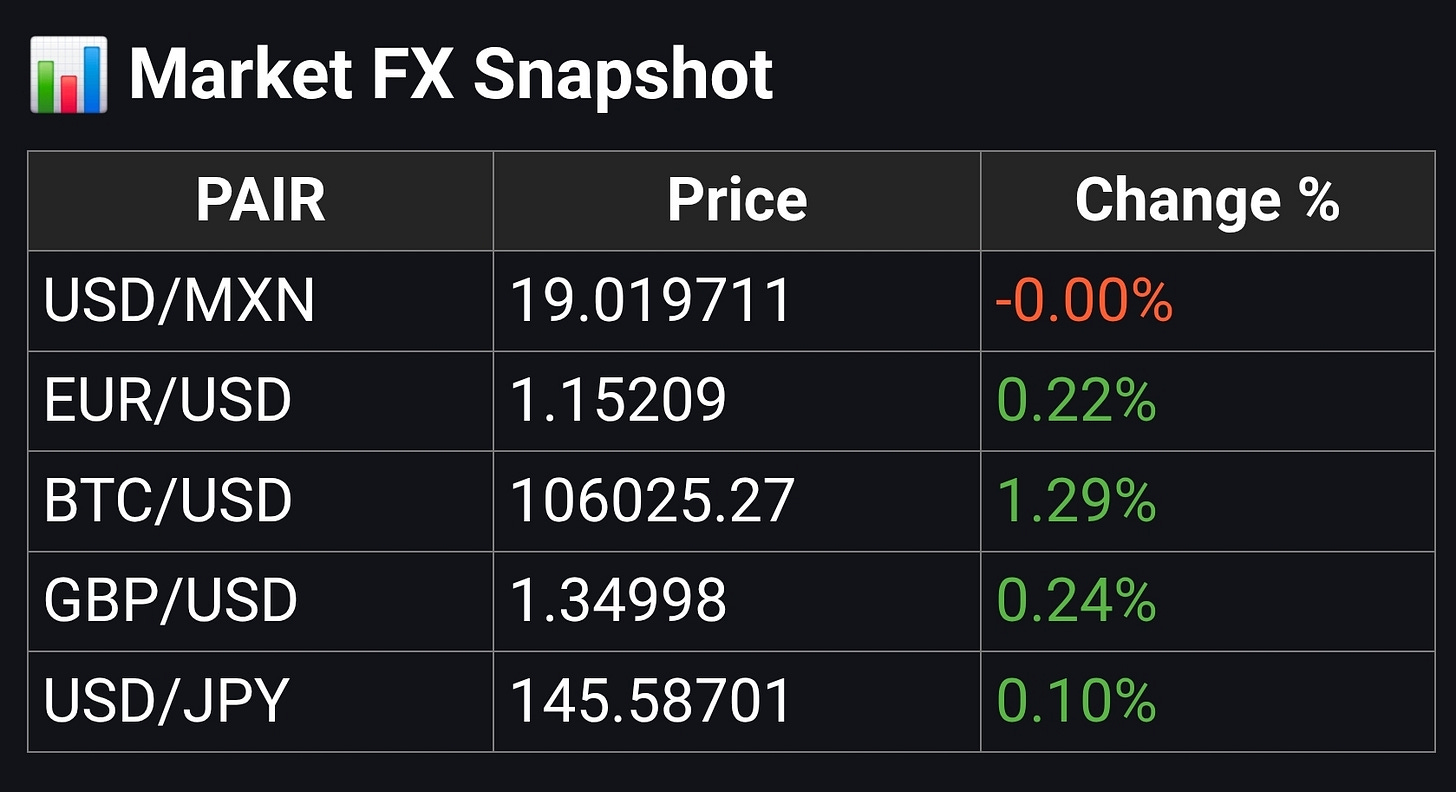

Dollar Options: A significant 15% to 30% of currency options contracts have shifted from the dollar to the euro, reflecting increasing competition for the U.S. currency.

Pop Mart in Trouble: Shares of Pop Mart International fell in Hong Kong after comments from Chinese state media calling for stricter regulations on surprise toy boxes.

SoftBank and Technology: Masayoshi Son of SoftBank is looking to partner with Taiwan Semiconductor to build an industrial complex in Arizona focused on robotics and artificial intelligence.

Japanese Bonds: Japan plans to reduce long-term bond issuance following record levels of volatility in yields, raising concerns in the market.

Circle Internet Group: The stablecoin issuer Circle Internet Group surged 13% in pre-market trading following the passage of cryptocurrency legislation in the U.S. Senate.

Home Depot Offering: GMS experienced a 20% increase after Home Depot made an offer for the construction product distributor, potentially starting a bidding war.

Eutelsat Up: Eutelsat shares rose 21% in Paris after announcing plans to raise €1.35 billion in new equity to expand its low Earth orbit satellite constellation.

Smith & Wesson Disappoints: Smith & Wesson shares fell 13% after reporting disappointing financial results due to consumer concerns about the economy.

Nuvation Bio: Nuvation Bio shares rose 4.5% after the biotech firm's CEO purchased nearly $900,000 in company stock.

Capital Flows: There is a growing disconnect between the U.S. and the rest of the world, which could lead to capital flows into emerging markets like South Africa.

Zealand Pharma Decline: Zealand Pharma shares have fallen 46% this year due to increasing competition and a prolonged wait for data on its experimental obesity drug.